Corporate Transparency Act Reporting Deadline Reminder – Jan. 1, 2025

The Corporate Transparency Act (CTA) became effective Jan. 1, 2024, and requires, with certain limited exceptions, that all corporations, limited liability companies, and similar entities created or registered to do business in the U.S. to file a beneficial ownership report (BOI Report) with the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) disclosing certain information concerning the entity, its beneficial owners, and, for newly-formed entities, the individual(s) involved in the entity’s formation.

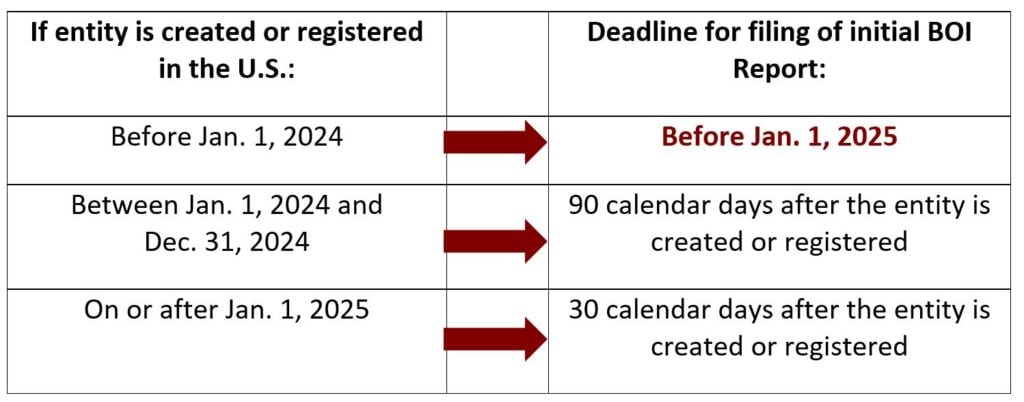

The deadline for filing an entity’s initial BOI Report depends upon the date on which the entity is created or registered to do business in the U.S.

Failure to file a BOI Report can result in both civil and criminal penalties.

In order to determine whether or not entities owned or controlled need to make a BOI Report before Jan. 1, 2025, please reach out to a Taft attorney(s). The sooner, the better, as both FinCEN and Taft expect a year-end rush to complete BOI Report filings.

Visit Taft’s CTA Toolkit here.

Additional Resources

You May Also Like

FAR Council Clarifies: Continuous SAM Registration Was Never Their Intent Update: IDOL Dispels Confusion, Says Illinois Is Not Banning E-Verify