Restructuring Partnerships, LLCs, and S Corporations To Benefit from the Qualified Small Business Stock Gain Exclusion

The Qualified Small Business Stock (QSBS) exclusion under Internal Revenue Code (I.R.C.) Section 1202 is an extraordinarily valuable benefit for C corporations and their shareholders. Section 1202 incentivizes and rewards equity investment in qualified small businesses by allowing holders of QSBS to potentially exclude up to $10 million — or an amount equal to ten times their basis — of the eligible gain realized from the sale of qualifying stock. Founders and early-stage investors of any business should carefully consider the benefits that Section 1202 could bring to enhance their return on investment upon a successful exit.

This article follows an earlier Taft law bulletin addressing the basics of the QSBS exclusion. Without addressing all of the requirements and limitations of Section 1202, one of the critical elements is that the issuing corporation must be a C corporation. Often businesses will initially organize as something other than a C corporation, such as a partnership, limited liability company (LLC), or S corporation. This bulletin describes how partnerships, LLCs, and S corporations can restructure in order to potentially qualify as eligible issuers of QSBS.

I. Partnership Restructuring Techniques

Companies currently operating as entities taxed as partnerships, including LLCs, LPs, and LLPs (referred to collectively as “partnerships” unless otherwise stated) may become eligible issuers of QSBS by (a) incorporating, (b) converting to a corporation under state law, or (c) “checking the box” to elect corporate status.

- 351 Contribution and Exchange. A partnership can perform an incorporation transaction in which new C-corporation stock is issued.1 By incorporating, partners will ultimately exchange their partnership interest for corporate stock. The IRS endorsed three methods for converting a partnership to a corporation: (1) in an “assets over” transaction, a partnership transfers assets to a corporation in exchange for stock of the corporation and then distributes such stock to its partners in liquidation; (2) in an “up and over” transaction, a partnership distributes its assets and liabilities to partners, and the partners then contribute the assets and liabilities to a corporation in exchange for its stock; and (3) finally, in an “interests over” transaction, partners transfer their partnership interests to a corporation for the corporation’s stock, resulting in all assets and liabilities of the partnership becoming assets and liabilities of the corporation.No matter the method, a partnership incorporation transaction generally does not result in tax gain recognition.2 There may be tax consequences, however, if the corporation assumes liabilities in excess of the tax basis of assets contributed to the corporation.3 In all cases, the partnership’s tax year will end and the new corporate tax year will begin on the effective date of the incorporation.

- State Law Conversion. Many states have statutory conversion laws that provide a relatively straightforward process for converting a partnership or LLC to a corporation. In Ohio, for example, the converting entity must prepare a written declaration of conversion and file a certificate of conversion with the Ohio Secretary of State along with the payment of a fee.4 When an unincorporated entity converts to a corporation under state law, an “assets over” transaction is deemed to occur.5 Thus, the conversion can generally be accomplished tax-free.

- Corporate Election (“Check-the-Box Election”). A partnership can also convert to a corporation by making a “check-the-box election” on Form 8832. Following the election, a partnership is treated as a corporation for federal income tax purposes.6 A check-the-box election is also considered to be an “assets over” transaction.7

II. Single Member LLCs

The owner of a single member LLC (SMLLC) can also incorporate using the techniques listed above. However, rather than directly converting the LLC entity to a corporation under a state law conversion, it can often make more practical sense to incorporate the LLC by contributing the membership interest — as opposed to its underlying assets — to a newly formed C corporation in exchange for all of the outstanding shares of that corporation. By contributing the membership interest in its entirety, the contributor maintains the LLC’s existence as a separate legal entity.8 This structure eliminates the need to formally assign contracts, employees, and benefit plans from the LLC to the new corporation.

III. S Corporations

Unlike the ability of a partnership or SMLLC to simply elect C corporation status, S corporations cannot qualify as an eligible issuer by simply revoking the corporation’s S election and becoming a C corporation. This is because the issuer must be a C corporation at the time QSBS is issued. There are, however, some restructuring techniques that S corporations can utilize to avail themselves of QSBS benefits.

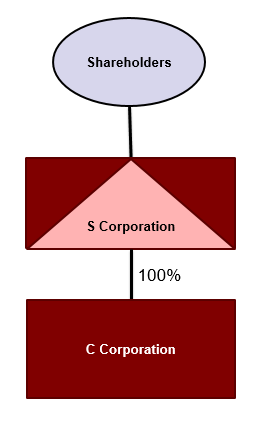

- Subsidiary Formation. Shareholders of S corporations may qualify for the benefits of Section 1202 by causing the S corporation to transfer the assets of a qualified trade or business to a newly formed C corporation in exchange for stock of such C corporation. As with the incorporation of a partnership, this transaction is generally not taxable under I.R.C. Section 351(a) unless liabilities assumed by the C corporation exceed the tax basis of transferred assets. This creates a tiered structure of shareholders owning an S corporation that owns 100% of the stock of a C corporation.

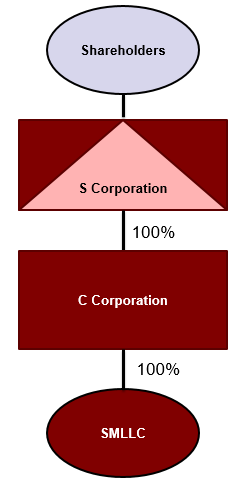

- “F” Reorganization and Contribution. Shareholders of the S corporation may also qualify for the benefits of Section 1202 by exchanging their stock in the S corporation for newly formed S corporation holding company stock in a transaction regarded as an “F” reorganization under I.R.C. 368(a)(1)(F). The subsidiary S corporation (“QSub”) is then converted into an SMLLC, the membership interest of which is then contributed to a C corporation in exchange for stock of the C corporation in a Section 351(a) exchange. As a result, the S corporation holds QSBS. The exchange results in a three-tiered structure of an S corporation holding a C corporation holding an SMLLC.

IV. Additional Considerations

Business owners should note that all of the restructuring techniques described above require that the gross fair market value of the business’s assets not exceed $50 million at the time of the restructuring. Furthermore, since all of these restructuring techniques involve pass-through entities, it is important to highlight Section 1202’s rules regarding eligible shareholders. Under Section 1202, any entity except a C corporation can hold QSBS. Eligible shareholders of QSBS include individuals, trusts, estates, partnerships, LLCs — taxed as a partnership or single-member — and S corporations.

For pass-through entities, additional requirements must be satisfied for the non-corporate owners of the pass-through entity to qualify for beneficial QSBS treatment. For example, when a pass-through entity holds and sells QSBS after the five-year holding period, only the members of the pass-through entity that were members at the time the pass-through entity acquired such stock shall be eligible to claim their proportionate share of the QSBS gain exclusion.

Each of the different restructuring techniques carries different benefits and limitations. Business owners should carefully consider any restructuring transaction to ensure it makes business sense and adds value for stakeholders. If you have questions about QSBS or how your company might benefit from restructuring, please contact your tax advisor or a member of Taft’s Tax practice.

1IRS Rev. Rul. 84-111.

2I.R.C. Section 351.

3I.R.C. Section 357(c).

4O.R.C. § 1701.811.

5IRS Rev. Rul. 2004-59.

6Treas. Reg. § 301.7701–3.

7IRS Rev. Rul. 2004-59.

8After the incorporation, the SMLLC is treated as regarded for non-tax purposes but is treated as disregarded for federal income tax purposes.

In This Article

You May Also Like

Navigating California’s Groundbreaking Climate Laws: What Out-of-State Businesses Need to Know Reshaping the Deal: Using AI in M&A