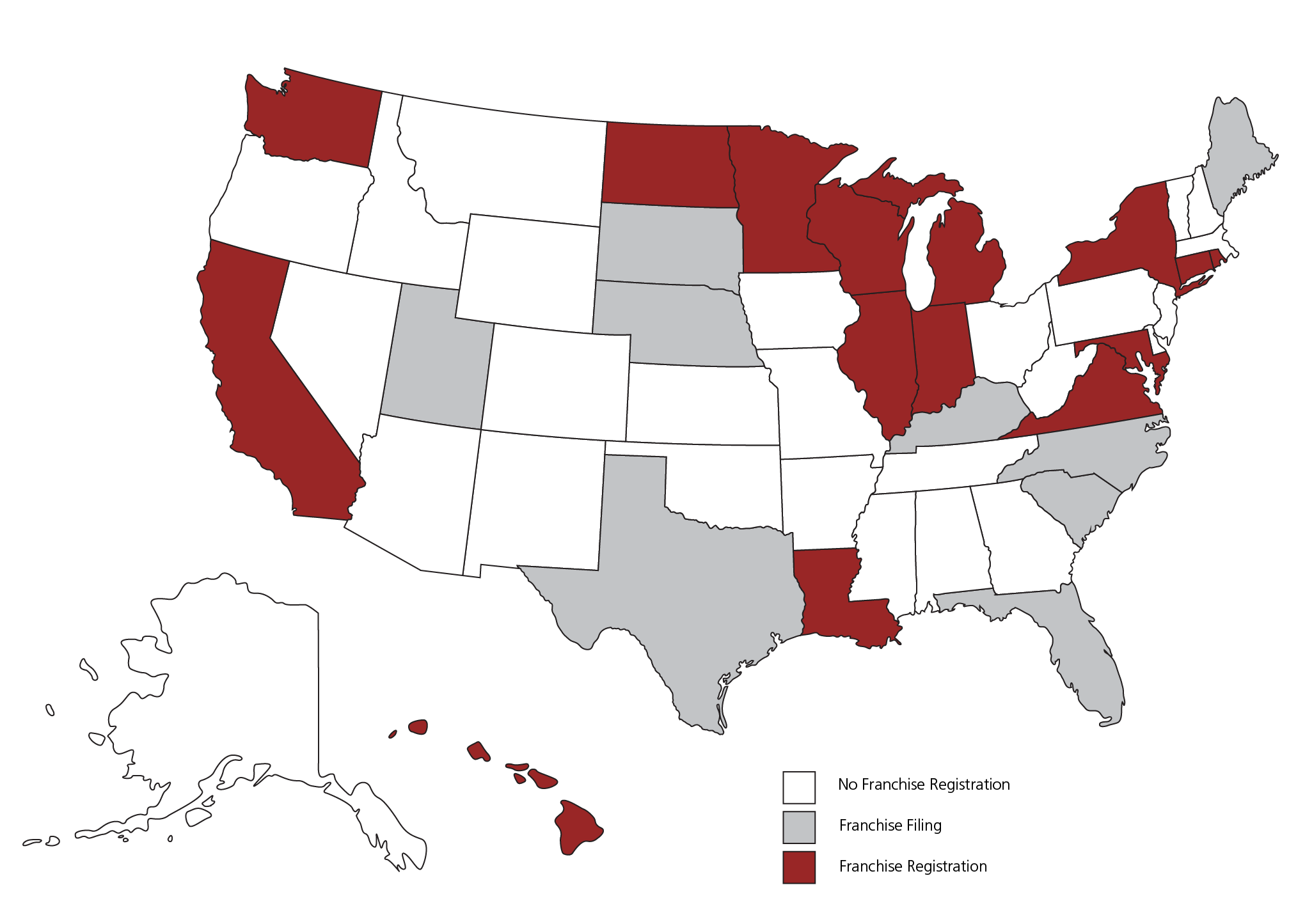

Franchise State-By-State Registration

Jump to: Franchise Registration States / Franchise Filing States / Non Registration States

Franchise Registration States

- California

California is a registration state, meaning it requires registration of business opportunities. Franchisors must apply for registration of the FDD with the California Department of Business Oversight in accordance with 10 CA ADC § 310.111. There are a handful of exemptions to California’s franchise laws that can be found in the California. Click here to read about the exemptions. - Connecticut

Connecticut is a registration state, meaning it requires business opportunities to be registered with the Connecticut Department of Banking. 236 C. 602. § 36b-62. However, a franchise whose primary trademark is registered with the USPTO may file an exclusion notice to claim an exemption from the requirement to register the FDD. 236 C. 602. § 36b-65. To learn more about the franchising requirements for Connecticut, please visit this website. Click here to read more about the exemptions. - Hawaii

Hawaii requires franchises to register its FDD with the Hawaii Department of Commerce and Consumer Affairs, according to Haw. Code R. § 16-37-1. There are a handful of exemptions to Hawaii’s franchise laws that can be found in §482E-4 of the Hawaii code. Click here to read about the exemptions. - Illinois

Illinois requires franchises to register the FDD with the Illinois Attorney General, per § 200.112 and Ill. Admin. Code § 200.600(c). There are a handful of exemptions to Illinois’ franchise registration requirements. Click here to read about the exemptions. - Indiana

Indiana requires that franchises notify the Indiana Secretary of State on a form prescribed by the commissioner in accordance with Ind. Code 23-2-2.5-10.5. There are a handful of exemptions to Indiana’s franchise registration requirements. Click here to read about the exemptions. - Louisiana

Louisiana requires some franchisors to register their FDD with the state, but not all. If an individual’s trademark is registered with the USPTO, then they do not need to worry about Louisiana’s Business Opportunity Laws. However, because of the Federal Franchise Rule, potential franchisors must provide their Federal Disclosure Document (FDD) to the prospective franchisee at least 14 days prior to signing the franchise agreement. - Maryland

Maryland requires franchises to file business opportunities before offering or selling any franchises in the state with Security Division of the Maryland Attorney General’s Office. Md. Code Regs. 02.02.08.04. There are a handful of exemptions to Maryland’s franchise registration requirements. Click here to read about the exemptions. - Michigan

Michigan requires franchises to file business opportunities before offering or selling any franchises in the state. Franchisors are not required to register the FDD, but must file a Notice of Intent with the Michigan Attorney General. Mich. Comp. Laws Serv. § 445.1507a. There are a handful of exemptions to Michigan’s franchise registration requirements. Click here to read about the exemptions. - Minnesota

Minnesota requires franchises to file business opportunities before offering or selling any franchises in the state. The FDD must be filed and registered with the Securities Division of the Minnesota Department of Commerce. Minn. R. 2860.1100. There are a handful of exemptions to Minnesota’s franchise registration requirements. Click here to read about the exemptions. - New York

New York requires franchises to register the franchise with the New York Attorney General in accordance with 13 CRR-NY 200.3. There are a handful of exemptions to New York’s franchise registration requirements. Click here to read about the exemptions. - North Dakota

North Dakota requires franchisors to file the FDD with the North Dakota Securities Department in accordance with. N.D. Cent. Code, § 51-19-07. There are a handful of exemptions to North Dakota’s franchise registration requirements. Click here to read about the exemptions. - Rhode Island

Rhode Island is a franchise registration state, as it requires franchisors to file the FDD with the Rhode Island Department of Business Regulation, Securities Division. R.I. Gen. Laws § 19-28.1-9(a)-(b). There are a handful of exemptions to Rhode Island’s franchise registration requirements. Click here to read about the exemptions. - Virginia

Virginia requires that before selling a franchise in the state, individuals must register with the Virginia Division of Securities/Retail Franchising. As a result, franchisors in Virginia need to comply with both the Virginia registration requirements and the Federal Franchise Rule. To comply with the Federal Franchise Rule potential franchisors must provide their Federal Disclosure Document (FDD) to the prospective franchisee at least 14 days prior to signing the franchise agreement. There are a handful of exemptions to Virginia’s franchise registration requirements. Click here to read about the exemptions. - Washington

Washington requires franchisors to file the FDD with the Securities Division of the Washington State Department of Financial Institutions, according to WAC 460-80-125. There are a handful of exemptions to Washington’s franchise registration requirements. Click here to read about the exemptions. - Wisconsin

Wisconsin requires franchisors to register the FDD with the Securities Division of the Wisconsin State Department of Financial Institutions. Wis. Stat. § 553.21. There are a handful of exemptions to Wisconsin’s franchise registration requirements. Click here to read about the exemptions.

Franchise Filing States

- Florida

Florida provides franchises an exemption from the registration of business opportunities if the franchise meets the definition of a franchise in the federal franchise rule, 16 CFR 436. A franchise need only file according to Fla. Stat. § 559.802. To learn more about the franchising requirements for Florida, please visit this website. - Kentucky

Kentucky requires franchises to file business opportunities before offering or selling any franchises in the state. A franchisor is exempt from the requirement to register business opportunities if it fits the definition of a franchise in the federal statute, 16 CFR 436. KRS 367.805. To learn more about the franchising requirements for Kentucky, please visit this website. - Maine

Maine requires franchises to file business opportunities before offering or selling any franchises in the state. Every seller must register with the Securities Administrator before offering to sell a business opportunity. This includes Franchisors offering franchises. (32 M.R.S. § 4696.) To learn more about the franchising requirements for Maine, please visit this website. - Nebraska

Nebraska requires franchises to file business opportunities before offering or selling any franchises in the state. A franchisor must file either state-specific disclosures or the FDD with the Nebraska Bureau of Securities. (Neb. Rev. Stat. 59-1724.) To learn more about the franchising requirements for Nebraska, please visit this website. - North Carolina

North Carolina requires franchises to file business opportunities before offering or selling any franchises in the state. A franchisor must file the FDD with the North Carolina Secretary of State before offering and selling a franchise. (N.C. Gen. Stat. § 66-95.) To learn more about the franchising requirements for North Carolina, please visit this website. - South Carolina

South Carolina has enacted the South Carolina Business Opportunity Sales Act. This Act requires some franchises to file with the South Carolina Secretary of State. As a result, franchisors in South Carolina need to comply with both the South Carolina Business Opportunity Sales Act and the Federal Franchise Rule. To comply with the Federal Franchise Rule, potential franchisors must provide their Federal Disclosure Document (FDD) to the prospective franchisee at least 14 days prior to signing the franchise agreement. To learn more about the franchising requirements for South Carolina, please visit this website. - South Dakota

South Dakota requires franchisors to file the FDD with the Director of the Division of Insurance. (D. Codified Laws § 37-5B-5.) To learn more about the franchising requirements for South Dakota, please visit this website. - Texas

Texas requires franchises to file business opportunities before offering or selling any franchises in the state. Texas requires registration before a business opportunity may be offered. A franchisor in compliance with federal franchise law may be exempt from the registration requirement if it files a Business Opportunity Exemption notice with the Texas Secretary of State. To learn more about the franchising requirements for Texas, please visit this website. - Utah

Utah requires franchises to file business opportunities before offering or selling any franchises in the state. Franchisors with a valid franchise under federal franchise act may be exempt from Utah’s registration requirement for business opportunities if the franchisor files a “Notice of Exemption” with the Utah Division of Consumer Protection. To learn more about the franchising requirements for Utah, please visit this website.

Non-Registration States

The following states do not require franchisors to register with the state. However, because of the Federal Franchise Rule, potential franchisors must provide their Federal Disclosure Document (FDD) to the prospective franchisee at least 14 days prior to signing the franchise agreement.

The 14-day window will begin when the prospective franchisee signs item 23 of the FDD confirming they have received the document. During the 14-day period, the franchise agreement cannot be signed and the franchisor cannot accept any payments from the franchisee. The FDD should be maintained in a safe place and should be updated annually.

After the franchise agreement has been signed, franchisors must provide franchisees with an operations manual which is to be kept confidential. This manual will act as a how-to-guide as the franchisee starts their franchise journey.

- Alabama

Alabama is a non-registration state. - Alaska

While Alaska is a non-registration state, it has enacted Business Opportunity Laws that are regulated by the Alaska Department of Law. These laws mandate that one must register as a seller in Alaska and pay a mandatory fee. But Alaskan law excludes franchises from their Business Opportunity Laws as long as the franchise complies with the Federal Franchise Rule. As a result, if a franchisor in Alaska complies with the Federal Franchise Rule, they have no other responsibilities required by the state. - Arizona

While Arizona is a non-registration state, it has enacted Business Opportunity Laws that are regulated by the Arizona Department of Revenue. These laws require individuals to comply with certain regulations in Arizona and pay a mandatory fee before selling a business. But Arizona law excludes franchises from their Business Opportunity Laws as long as the franchise complies with the Federal Franchise Rule. As a result, if a franchisor in Arizona complies with the Federal Franchise Rule, they have no other responsibilities required by the state. Arizona has not enacted state franchise laws, but all franchises must comply with federal franchise law. - Arkansas

While Arkansas is a non-registration state, it has enacted the Arkansas Franchise Practices Act. The Arkansas Franchise Practices Act does not require that franchisors register their franchise with the State or pay any sort of fee, but rather provides additional protections for franchisors and franchisees. For example, franchisees are given private rights of action and franchisors must give 90 days’ notice if they are going to terminate or cancel the franchise. Moreover, to cancel/terminate a franchise, the franchisor must have “good cause” to do so. Finally, the Act requires franchisees to provide franchisors with notice if they intend to transfer a franchise. Upon receiving written notice, the franchisor has 60 days to either approve/disapprove the request and disapproval requires specific reasoning for the denial.

The Arkansas Franchise Practices Act regulates behavior after the franchisor/franchisee have established a relationship and does not require any other action prior to the agreement. Additional protections and more information about the Arkansas Franchise Practices Act can be found here. - Colorado

Colorado is a non-registration state. - Delaware

While Delaware does not have a law that requires registration, it does have the Delaware Franchise Security Act. This legislation only impacts franchisors and franchisees if a franchisor wrongfully terminates, ends, or fails to renew the franchise agreement. As a result, franchisors in Delaware only need to comply with the Federal Franchise Rule when registering their franchise but should remember that this law applies to franchise termination. More information about the Delaware Franchise Security Act can be found here. - District of Columbia

While DC does not require registration, the District has implemented the Consumer Protection Procedures Act. This Act will not apply to franchisors or franchisees during the registration process, but does protect franchisees in instances of deceptive and unconscionable business practices. More information about these protections can be found here. - Georgia

While Georgia does not require registration with the State, they have implemented Business Opportunity Laws that regulate the sale of businesses. These laws specifically regulate what must be disclosed prior to the sale of a business. But if an individual has a principal trademark registered with the United States Patent and Trademark Office, they are exempted from these laws. But if an individual does not have a trademark registered with the USPTO, they need to ensure they have complied with the Georgia Business Opportunity Laws. If they do not have a registered trademark and the Business Opportunity Laws apply, Georgia Code 10-1-410 lays out exactly what must be disclosed in the sale of a business (most of these disclosures are already included in the FDD, but franchisors should go through the list to ensure they have included everything). The full list can be found here. - Idaho

Idaho is a non-registration state. - Iowa

While Iowa does not require registration, the State has enacted Business Opportunity Laws. But a franchisor is exempt from these laws as long as they abide by the Federal Franchise Rule. - Kansas

Kansas is a non-registration state. - Massachusetts

Massachusetts is a non-registration state. - Mississippi

Mississippi is a non-registration state. - Missouri

While Missouri does not have any law requiring registration with the state, they do have a state statute that deals with franchises that individuals should be aware of. Under Missouri law, a franchisor cannot terminate or cancel a franchise agreement without notifying the franchisee at least 90 days before the cancelation except in instances of criminal misconduct, fraud, abandonment, bankruptcy, or giving insufficient funds checks. More information is available here. - Montana

Montana is a non-registration state. - Nevada

Nevada is a non-registration state. - New Hampshire

New Hampshire is a non-registration state. - New Jersey

While New Jersey is a non-registration state, it has enacted the New Jersey Practices Act. This legislation limits franchise agreement provisions and governs the relationship between franchisors and franchisees. Both franchisors and franchisees should be aware of these rules as they add additional hurdles to the relationship. Under the Act, if a franchisors decides to terminate a franchise they must give at least 60 days’ notice before doing so. In addition, if a franchisee decides to sell their franchise, the franchisor must give a decision on whether they will approve the request within 60 days of receiving the notice. Finally, a franchisor cannot require a general release for a franchise agreement. More information can be found here. - New Mexico

New Mexico is a non-registration state. - Ohio

While Ohio does have Business Opportunity Laws, if franchisors comply with the FFR, they are excluded from these state laws. More information about these Ohio business laws is available here. - Oklahoma

While Oklahoma does have business opportunity laws, if franchisors comply with the FFR, they are excluded. - Oregon

Oregon is a non-registration state. - Pennsylvania

Pennsylvania is a non-registration state. - Tennessee

While Tennessee does not require registration, the State has implemented Tennessee Consumer Protection Act. The Act mandates that to terminate a franchise relationship, the franchisor must act in good faith and have good cause for termination. Moreover, franchisees must be given 30 days or more and have reasonable opportunity to fix the cause. More information can be found here. - Vermont

Vermont is a non-registration state. - West Virginia

West Virginia is a non-registration state. - Wyoming

Wyoming is a non-registration state.

This information is subject to our Terms and Conditions.